Manhattan Beach Property Taxes

When buying a home here, be aware of the property tax rates for Manhattan Beach.

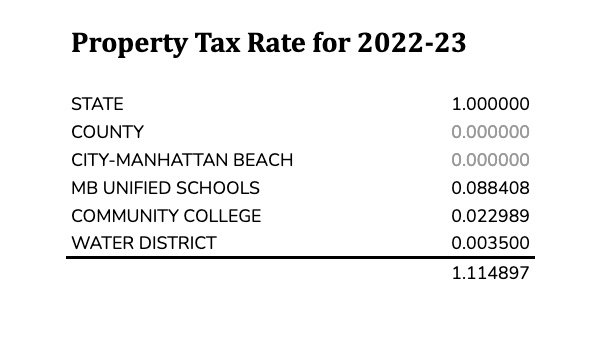

For fiscal year 2022-23, the property tax rate is 1.114897%.

The property tax rate typically is applied to the sale price of a recently purchased home, with no separate appraisal or assessment performed by the county. (There can be exceptions.)

Here is where the various charges on your Manhattan Beach property tax bill come from:

- State of California: 1.0%

- County of Los Angeles: 0%

- City of Manhattan Beach: 0%

- MB Unified School District: 0.088408%

- Community Colleges: 0.022989%

- Metropolitan Water District: 0.0035%

As you can see, neither Los Angeles County nor the City of Manhattan Beach imposes additional property taxes.

The greatest local charge is for local schools. (Also one of the greatest assets for Manhattan Beach!) It comes to about $884 per year per million dollars in assessed value.

The rate is stable, down about 7 ten-thousandths of a percent since FY 2020-21 (-0.0007111%).

Estimating Property Tax for a New Purchase in Manhattan Beach

On a sample purchase of $2,000,000, this tax rate would result in property taxes of $22,298 per year, or about $1,858 per month.

These figures, from the LA County Auditor-Controller, do not reflect additional charges expected for the repayment of bonds approved by the voters of Manhattan Beach, such as the recent bonds for school facilities (see below). The latest bonds may result in new charges of up to $30 per $100,000 in assessed value on each property in Manhattan Beach as the bonds are issued. (Or about $600 per year on a sample purchase of $2,000,000.)

Under California law (Proposition 13), the assessed value of a property may increase by 2.0% per year. When property values decline, the assessed value can be challenged by a homeowner appeal, or may be reduced by the LA County Assessor automatically without such an appeal.

To find updated figures from the Auditor-Controller directly, go to this web page. This allows you to look up current rates and those for the prior year. You will need to input one of the Tax Rate Areas (TRA) for Manhattan Beach, such as 3716. (You can use any TRA for MB, from 3716-3724, 3731, 6154-6156, or 6168-6175 [except 6171].)

Manhattan Beach Measures C, EE and MB

On November 8, 2016, the voters of Manhattan Beach approved two bond measures:

- Measure C is a $114 million measure that will be used primarily to improve infrastructure at elementary schools (including completing air conditioning for all classrooms), replace the Ladera campus at Grand View, and make improvements to each elementary site. Measure C received 71.4% of votes in favor, with 55% required for passage. It is estimated to add $22.00 per $100,000 in assessed value to a typical homeowner's tax bill, though this may change slightly.

- Measure EE is a $39 million measure to replace the outdated and undersized gymnasium at Mira Costa High School. Measure EE received 67.4% of votes in favor, with 55% required for passage. It is estimated to add $8.00 per $100,000 in assessed value to a typical homeowner's tax bill, though this may change slightly.

On June 5, 2018, the voters of Manhattan Beach approved Measure MB, a parcel tax dedicated to school funding. Measure MB levies a $225 per year per parcel tax for 6 years. The parcel tax is expected to raise about $2.6 million per year for local schools at a time of declining state funding. The measure received 69.25% support from the voters.

Work with Dave Fratello

Looking for help with your home search or sale? MB Confidential producer Dave Fratello is an active local broker with Edge Real Estate Agency. He and the team would be honored to help!

Edge is a full-service, boutique real estate agency representing buyers and sellers. We are experts in residential real estate in Manhattan Beach and nearby South Bay real estate markets.

We’re different because we uniquely blend online savvy, tech proficiency, marketing expertise, local knowledge and experience with negotiations and transactions in this area. For any question or a free consultation, reach out to Dave today!